Focusing on the Quality of Your Reps

10 hours ago

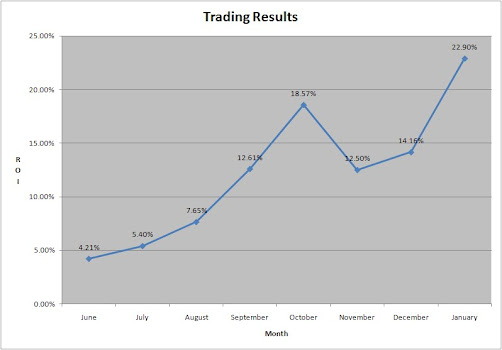

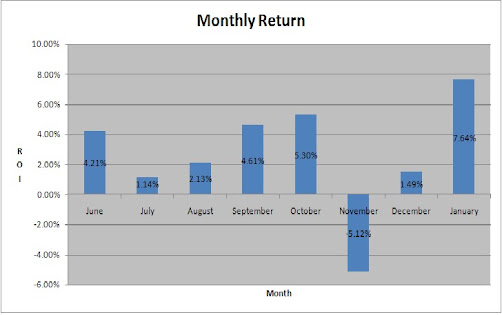

The purpose of this blog is to track my currency trading results. I will endeavor to keep this updated with results of trades, reasoning behind the trades, and other useful information about the topic. ------------------------------------------------------ This is not investment or trading advice.