Trading Account

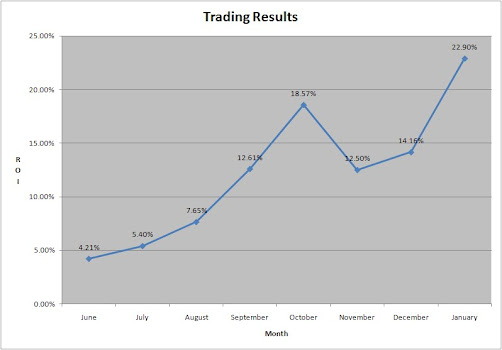

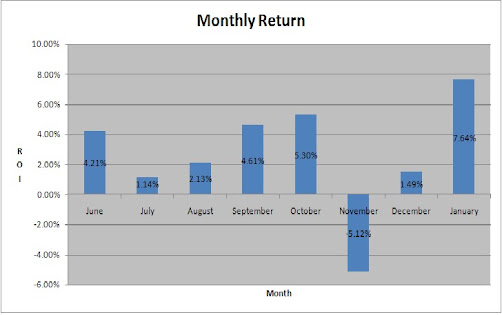

Monthly Trading Results

Thursday, March 26, 2009

Trading results 3/26

Wednesday, March 25, 2009

Trading results 3/25

Thursday, March 19, 2009

Trading results 3/19

Wednesday, March 18, 2009

Trading results 3/18

Tuesday, March 17, 2009

Trading results 3/17

Mid-day update 3/17

Monday, March 16, 2009

Mid-day update 3/16

Friday, March 13, 2009

Mid-day update 3/13

Actually this is a good time to mention my exit strategy. When the pair reaches my targeted exit I close the side of the trade that is at a loss and put a trailing stop on the side in profit to see if I can catch a move on that one pair. It doesn't run every time, or even most of the time, but when it does it can multiply what would've been a nice gain by 2 or 3 times.

Its reassuring to see that absent the craziness from yesterday the premise is sound. Not expecting much for the rest of the day, Friday afternoons tend to be very quiet since the rest of the work is already enjoying their weekend.

Thursday, March 12, 2009

Trading Results 3/12

Wow! Bad Day.

Wednesday, March 11, 2009

Trading Results 3/11

Mid-day update 3/11

The trading plan

A third pair is chosen as the trigger for entries and exits because it is a combination of the two traded pairs. I watch this pair for movements of a minimum size to enter a position. If the trigger moves up the required amount I will enter a short position in both traded pairs, if it moves down instead I will enter a long position. When/if after my entry the trigger pair moves back towards the starting price I will close the position. That is the main theory of the strategy, the price will revert to the mean over time.

What is being traded?

EUR/USD and USD/CHF pairs.

Trigger for entries/exits?

EUR/CHF.

Schedule for entries/exits?

1lot -0.25( or +0.25 of course)

lot 2 -0.25

lot 3 -0.25

lot 4 -0.50 exit 0.25 pull back (pb)

lot 5 -0.50 exit 0.25pb

lot 6 -1 exit 0.50 pb

lot 7 -1 exit 0.50 pb

lot 8 -2 exit 1 pb

lot 9 -2 exit 1 pb

lot10 -3% double lots exit 2pb.

A lot is also referred to as a position and consists of the combination of both traded pairs entered at a specific time. The -.25 is referring to a percentage move so I'm looking for the EUR/CHF to move +/- .25% from the closing price before entering the first position and so on. Unless otherwise specified above I close a position when it retraces .25% in the direction of the trade.

Ratio of EUR/USD to USD/CHF?

The goal is to be as close to U.S. Dollar neutral as possible because that helps to eliminate one more risk to the portfolio. When entering a trade I check to see what the EUR/USD is trading at because this is used as a quick reference on the ratio I want to maintain. As an example if the EUR/USD is trading at 1.50 then every position is long/short 100,000 Euros and short/long 150,000 Dollars. I want to cover these 150,000 Dollars so I will buy 1.5 units of USD/CHF for every 1 unit of EUR/USD. This means my effective trade could be long 100,000 Euros, short 150,000 Dollars and long 150,000 Dollars, short 116,000 Swiss Francs (assuming the USD/CHF is trading at 1.16). It isn't important how many more or less Euros or Francs are in each position, just that as much of the Dollar risk is hedged out as possible.

Size of each position?

I stay between 3 and 3.5% of the total portfolio value for each position. So for each $100.00 in the account I only want to start with $3.00 to $3.50 total between both pairs. The reason for this is that the price doesn't always revert back to the mean immediately, sometimes it can move against me for quite a while so I need to have the capacity to open more positions and not get a margin call. The second important fact that impacts the size is the ratio mentioned above.

Time frame and what to use as a starting point?I only use a 1 hour chart of the EUR/CHF but it doesn't really matter much. As far as a starting point to determine how far away from the mean the price moves I use the GMT 0:00 opening price as my starting point (this is the open of the bar at 7pm EST).

When I trade?

I try and watch the market as much as possible but the best times seem to be from the opening of the London session to mid-afternoon in the U.S.

Tuesday, March 10, 2009

Trading Results 3/10

Monday, March 9, 2009

What is currency trading?

Here are some FAQs from Investopedia but the nuts and bolts are that the currency market is a worldwide, completely electronic market for the buying and selling of foreign currencies.

What makes it different from trading stocks, commodities, or options?

First, the hours. Depending on which broker you choose you can take trades 24 hours a day from 5pm Sunday to 4pm Friday. How is this? The market services the entire globe so when the east coast of the U.S. is finishing dinner the Asian markets are just getting warmed up. An hour or so before they call it a day the London session kicks into gear and takes us well past the traditional start of the trading day in America.

Second, the volume. Depending on who you talk to the average daily dollar amount of trades is anywhere from US$2 trillion to US$3.5 trillion. Compare that to the highest monthly dollar volume the NYSE Group has had in the past 5 years of US $3.6 trillion. When you take this extremely high volume and divide it across the 20 to 30 pairs able to be traded at most currency brokers, instead of the thousands of stocks listed on any given exchange you get one beautiful thing....liquidity.

Third, the leverage. If you want to lever up (trade more shares of a stock than you can afford) in the stock market you have to have a fairly large account and have to borrow the shares on margin from someone, most likely your broker. Currency brokers provide automatic leverage from 50:1 to 400:1 or even higher. This is actually necessary in most instances anyway since the standard currency contract size is 100k. This makes the barriers to entry very small.

It begins

This is best described as a mean reversion dollar neutral hedge strategy, which I'll get into more as I go along. I did not come up with this system. Rather it was posted on ForexFactory, a currency trading forum. I will attempt a brief description of the strategy but anyone interested in trading should read all of the posts for Spieler’s strategy here.