Trading Account

Monthly Trading Results

Friday, July 31, 2009

Quick move down

The E/C just dropped 25 pips in 2 minutes. Looks like it was a pop in the EUR/USD that caused the rapid decline.

Thursday, July 30, 2009

Trading Update 7/30

Closed the last half long position so I am now all cash. Would probably enter short here but am planning on withdrawing the bulk of my funds from the account and transferring them to my new broker.

News update on the Euro-Swiss

EURO-SWISS: Trading with a buoyant tone and tracking dollar-Swiss gains

the cross taking out the 76.4% retrace of the June-July sell-off at

Chf1.5316 and pushing on to Chf1.5335 at writing. Techs now highlight

trendline support from the March highs coming in at Chf1.5357 ahead of

the June peak at Chf1.5380.

Trading Update 7/30

I closed half of my last long position at 1.5311. This leaves me with only one half position left and my take profit point 30 pips away.

Another Euro Swiss news update

EURO-SWISS: Extending this week`s highs and moving towards offers in the

Chf1.5300 area as dollar-Swiss remains buoyed just off best levels. A

break above the figure to expose the 76.4% retracement of the June-July

sell-off at Chf1.5316 with traders then noting expiry interest for the

NY cut at Chf1.5350. June spike highs seen as the ultimate target at

Chf1.5380.

Interesting morning action

The EURCHF just gapped up 8 pips at the start of the London Session (3am EST/7am GMT). This is not a regular occurrence, actually it is fairly rare in my opinion. 8 pips isn't significant and it will probably close right away but still very interesting. Also, here is a list of today's expiring options on a few currencies. Please notice the Euro-dollar and Euro-Swiss, these could play a roll in today's price action depending on where the pairs are coming up to the cut. I'll discourse on options more later.

FX OPTIONS: Expiries of note for today`s 1400GMT/1000EDT cut

* Euro-dollar; $1.4085(lge) $1.4100 $1.4000 $1.4300

* Dollar-yen; Y95.35 Y94.70/80 Y94.00 Y96.00

* Euro-yen; Y134.00 Y135.00

* Cable; $1.6500

* Euro-Swiss; Chf1.5350

* Aussie; $0.8200 $0.8175

Wednesday, July 29, 2009

News update on the Euro-Swiss

This came across the wire at 10:24 am EST today. Nothing revolutionary but it is interesting to see how much the interventions have cost the SNB, and that there is another benefit to them owning Euros.

EURO-SWISS: Marc Chandler of Brown Brothers Harriman estimates that

the SNB has spent $32bn to keep the SFC from firming (vs the euro)

since March. He says Swissy has fallen about 4.3% vs the euro over this

period. Chandler stresses however that the increase in SNB euro holdings

may also have a "valuation component" to it as well. Intervention is one

of the SNB`s "unique" QE tools he reminds. "Whereas the US Japan and

the UK bought their own bonds the SNB says its bond market is too small

so it has to buy foreign bonds and to do so of course requires buying

foreign currencies" Chandler says. Euro-Swiss currently at Chf1.5240

saw a range of Chf1.4576 to Chf1.5447 in March remained in tight ranges

in April and May and saw a Chf1.5004/Chf1.5380 range in June. In July

so far the cross has Chf1.5106 to Chf1.5271 with today`s spike caused

by remarks by SNB`s Jordan stating the SNB would continue to intervene

if necessary.

Trading Update 7/29

Closed another half long position at my profit target. This leaves me with 1 full long position open. Spreadsheets and charts will be updated shortly.

Tuesday, July 28, 2009

Missed opportunity?

I had to leave today and set a limit on a half position I have open that was within 25 pips of my target. When I returned I found that my limit was 4 pips over the highest level reached today. Was my target too high? I don't believe so. This is a business and my plan is to make a certain amount of money on each trade, so if the market doesn't want to give that to me today then I'll wait a while longer.

Monday, July 27, 2009

Trading Update 7/27

I just closed half of my 2nd long position at 1.5244. I'm still sitting on 1.5 long positions.

Sunday opening action

The EURCHF opened with a 20 pip gap down yesterday afternoon. This presented a short-term trading opportunity to enter long and look to take profit as soon as the gap closed. I decided against entering this gap trade because neither the EURUSD or USDCHF appeared to have any gap at all, nor was there any recollection of the gap on the news wires.

As I write this the pair is sitting at 1.5247, right at resistance from the end of last week. If we can break the 1.5250 level convincingly then I should be able to ring the register on some nice pips from my 2nd long position.

Saturday, July 25, 2009

Weekly wrap-up

I have just returned from a week long vacation in Puerto Vallarta, Mexico. It was a great time and I recommend it to anyone looking for a relaxing time by the ocean.

As I was on vacation this week I had set some take profit orders for my open positions, which were never quite hit. So the week passed without any trades opened or closed, and I am still holding 2 full long positions.

Wednesday, July 15, 2009

Charts and Trades

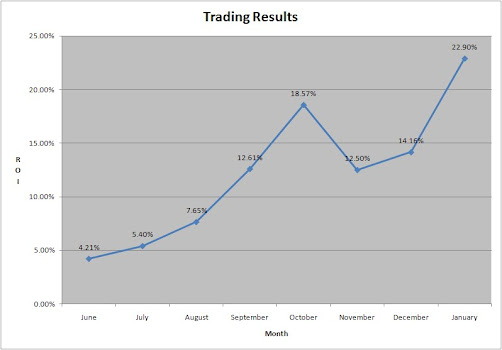

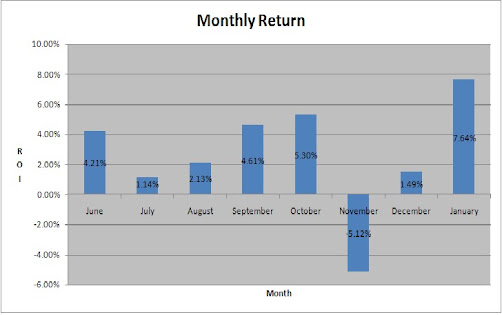

I just updated the total return chart and added the monthly return as well as the closed trade list. As you can see from the trade list I haven't had a losing trade yet. Then why is the account down .2% this month? Fees. Since I hold positions for days or even weeks, my broker charges the standard "roll rates" for holding the position overnight. These fees have not been offset by closed trades, which is usually the case. Also, this has the potential of being a losing month based on circumstance alone.

I am going on vacation to Mexico this Friday and am not counting on being able to access the trading platform while out of the country due to spotty internet access. Who wants to work on vacation anyway? This wouldn't normally be a problem except that the new NFA First-in First-out rules go into effect on August 1st. After that date I will no longer be able to close an individual position that is profitable, instead the oldest position will be closed first. My plan is to transfer the account to another broker to avoid these issues but I will either have to close out the positions where they are when the transfer is to take place, or leave some money in this account and transfer the balance. Neither option is ideal, but unless the price moves up from today's high that is the decision that I will have to make.

Tuesday, July 14, 2009

Trading update 7/14

Just closed a half position at 1.5189, which was a 30 pip gain from entry. This is a fairly strong move up considering the London session should be wrapping up if it already hasn't. I'm still long 2 full positions so this mini-trend can continue on all week in my book.

Monday, July 13, 2009

Interesting article on currency trading

This month's issue of Currency Trader Magazine has an excerpt from a new book by Marc Chandler, "Making Sense of the Dollar". The piece gives a good background of participants in the currency markets and what their motivation and advantage could be. Not every player is looking for speculative profits, even though their participation impacts ours.

Sunday, July 12, 2009

Weekly wrap-up

I'm holding 2.5 long positions going into this week. Last week saw only 1/2 of a position closed for profit, which puts me down for the week when you count the roll paid to my broker for holding the positions open overnight for so long. The EURCHF has been on a steady move down since the intervention a couple weeks back. The plan hasn't changed, "Buy the dips and sell the rips."

There are a couple of macro items on the Swiss agenda for the week: ppi and retail sales. However, neither of these will have much of an immediate impact on the pair. It is a good idea to keep track of these because when the SNB sees that their export economy is starting to get back into form they could start to pull back on their goal of devaluing the Franc.

Thursday, July 9, 2009

New middle eastern currency delayed

Snippet on Euromoney.com stating the the GCC have extended their deadline 3 years to have a group currency for that region, much like the Euro.

Trading update 7/9

Earlier I closed the position opened yesterday on the run up during the 8 AM EST hour.

Wednesday, July 8, 2009

Trading Update 7/8

Opened the 2nd half my 3rd long position at 1.5136. This was a fairly quick run down, and it could well have further to go, but I wanted the opportunity to capitalize on the move back up that should be coming very soon.

G8 meeting

Among the many topics to be discussed over the next three days are the recent calls for a move away from the U.S. Dollar as the world's reserve currency. It seems like every other week a headline says that China or someone else is wanting to establish a new reserve currency. Then, like clockwork, another article is ran stating that no such comments were made.

Here is a link to the official website of the G8 meeting in Italy. Some other topics on the agenda are the economic crisis, international trade, climate change, and many others.

Tuesday, July 7, 2009

Monday, July 6, 2009

Trading update 7/6

I opened half a long position at 1.5159. The take profit target is 1.5209. The price action was muted for the rest of the day so we'll have to wait until tomorrow for an opportunity to either take this more recent entry off the table or complete the position on further movement south.

Break to the downside

Not long after I posted the range of the past couple days the pair broke to the downside through the low and is sitting at 1.5167 right now. There was a strong movement to get to this point but the momentum, at least for the moment, has stalled. It appears that the sentiment is to the downside with traders possibly trying to force the SNB to act again and again to book quick profits. The stair-step down could result from no one really knowing when or where another intervention would happen and the shorts not wanting to get caught out with big positions.

Starting the week

News Events: Other than the Swiss Unemployment Rate being released on Wednesday morning this is a quiet week for data. The unemployment probably wont have much of an impact on the EURCHF but keeping track of upcoming news events is very important for any trader, especially a currency trader.

Technical View: The EURCHF seems to be in a short-term range of 1.5175 to 1.5250. The former is the low from 7/2, which is the lowest point achieved by the shorts since the big move up on 6/24. The longs haven't been able to push the pair past 1.5250 since late session on 7/1.

Open Positions: I have 2 positions open at 1.5261 and 1.5194 respectively. The target for the 2nd position is 1.5250 which was hit on Friday morning but I left it open to see just how far some buy side interest could push the pair considering the extremely low volume of a holiday weekend in the U.S.

Friday, July 3, 2009

Small spike this morning

At 5:45 a.m. this morning the EURCHF spiked up 40 pips or so. The question most likely on trader's minds, including mine, at the time was the likelihood of this being the result of some sort of intervention. As the pair just hit my take profit target for my 2nd long position and the motivation behind the move was still in question, I decided to keep the position open. The news wires finally reported that it was an U.S. investment house behind the move. As such if the pair moves up to the 1.5250 level again today I will probably take the 2nd position off the table.

Thursday, July 2, 2009

Trading update 7/2

Opened the 2nd half of my long position at 1.5194. The overall trend looks to be down since the last spike up on June 25th. However, my strategy is not to ride a trend. With the new NFA rules about being long and short the same instrument I'm looking for a retracement to the 1.5240 area to close this 2nd position.

More from the SNB quarterly report

There is a statement on page 29 about how the depreciation of the franc against the euro has been partially offset by the appreciation of the franc against the dollar. This statement could lend some credibility to the claims that the 2nd big move last Thursday that started with the USD/CHF was some sort of intervention.

There isn't much more about their past or future interventions but there is some interesting economic data and viewpoints. Basically, they think that the economies of most industrialized nations will begin to grow modestly late this year, mostly as a result of government stimulus. China has already hit the bottom and should rebound quicker than the rest of us, and it will take a number of years for the various governments to recover from this massive stimulus/debt binge. Chart 2.4 on Page 17 gives a pretty good graphical representation of why the Swiss economy is so closely tied, and their currency so correlated, with the European Union, and its all about exports.

There isn't much more about their past or future interventions but there is some interesting economic data and viewpoints. Basically, they think that the economies of most industrialized nations will begin to grow modestly late this year, mostly as a result of government stimulus. China has already hit the bottom and should rebound quicker than the rest of us, and it will take a number of years for the various governments to recover from this massive stimulus/debt binge. Chart 2.4 on Page 17 gives a pretty good graphical representation of why the Swiss economy is so closely tied, and their currency so correlated, with the European Union, and its all about exports.

Today's news events

The U.S. Unemployment numbers came in at a loss of 467,000 jobs, quite a bit more than the 350,000 loss that was expected. The unemployment rate ticked up to 9.5% with a total of 6.5 million jobs lost since the start of the recession, according to the Wall Street Journal. The ECB, as expected, left its key interest rate alone at 1%.

The only noticeable impact of either event is the EURCHF retracing half of the move upward that came on the heels of the quote I shared in an earlier post from the SNB. This retracement could also just be the natural order of things and have nothing to do with either news event today.

The only noticeable impact of either event is the EURCHF retracing half of the move upward that came on the heels of the quote I shared in an earlier post from the SNB. This retracement could also just be the natural order of things and have nothing to do with either news event today.

SNB comments this morning

The Swiss National Bank released their quarterly report this morning. I haven't made it through the entire document yet but here is one key statement, "It will take firm action to prevent an appreciation of the Swiss franc against the euro." This report is as of mid-June when the EURCHF was somewhere between 1.5200 and 1.5050, so that doesn't necessarily mean that they will take action at this level. I will continue to review the document and post about what I find relevant or interesting.

Wednesday, July 1, 2009

Trading update 7/1

There was a fairly quick run down in the EURCHF from 1.5240 to 1.5213 which prompted me to open half a long position at 1.5220. Price continued to dip to a low of 1.5199 but has recovered almost to my entry point as of now. I had posted a couple days back that a break of the 1.5200 barrier could lead to another quick 50 pips on the downside. That could still be the case, however, there seems to be support at that level right now so it remains to be seen if we'll see a solid break to the downside from here.

There is still, in my opinion, a sense of uncertainty about when or if another intervention could happen. There's the U.S. Unemployment numbers tomorrow and then the long holiday weekend here in the U.S. which does make me question whether or not the SNB could take advantage of the expected light volume on Friday to run the pair up going into the weekend.

There is still, in my opinion, a sense of uncertainty about when or if another intervention could happen. There's the U.S. Unemployment numbers tomorrow and then the long holiday weekend here in the U.S. which does make me question whether or not the SNB could take advantage of the expected light volume on Friday to run the pair up going into the weekend.

Tight range this week

The EURCHF is trading in a very tight range after the large moves seen over the past 2 weeks. 73 pips from top to bottom so far with my position open just over half-way up that range at 1.5260. The tight range and location of my position equals no trades so far this week. There is an ECB press conference tomorrow at the same time as the release of the U.S. Bureau of Labor Statistics monthly unemployment rate, which could explain the range seen so far this week.

June wrap up

June is now history and it was a pretty decent month. The portfolio was up 4.21% for the month which is respectable. The goal isn't to double the account each month, instead I am focusing on consistent profits month in month out.

I opened and closed a total of 16 trades in the month of June. Since I leg into positions this isn't an accurate representation of total positions traded, that number is closer to 10. This trading strategy does not require extremely active trading, which is one of its strengths. Going into July I am still holding 1 long position.

I opened and closed a total of 16 trades in the month of June. Since I leg into positions this isn't an accurate representation of total positions traded, that number is closer to 10. This trading strategy does not require extremely active trading, which is one of its strengths. Going into July I am still holding 1 long position.

Subscribe to:

Posts (Atom)