Trading Account

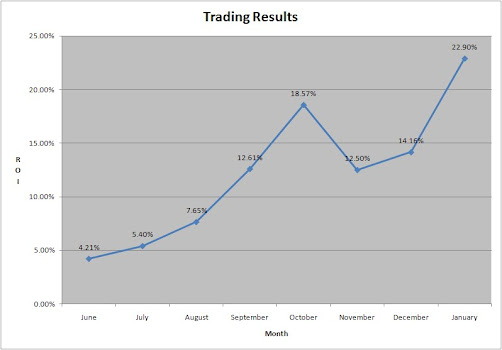

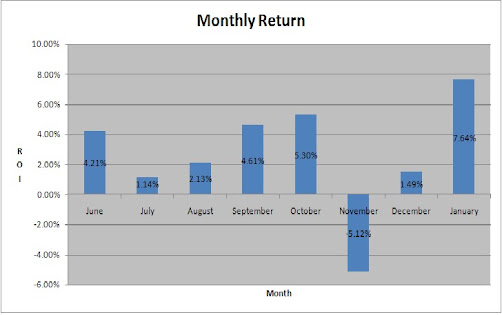

Monthly Trading Results

Tuesday, December 1, 2009

November wrap-up

Wednesday, November 25, 2009

Giving Thanks

Monday, November 23, 2009

Today's wrap-up

Friday, November 20, 2009

Weekly wrap up

Discipline

Wednesday, November 18, 2009

Learning to trade

Still in a range day

Tuesday, November 17, 2009

Decent day

Friday, November 13, 2009

Weekly wrap up

Thursday, November 12, 2009

Patience

Happy Veterans Day!

Tuesday, November 10, 2009

Learning Curve

Thursday, November 5, 2009

Better

Wednesday, November 4, 2009

Greed is (not always) good

Results for Wednesday: 1 good entry long gbpusd at a short-term reversal candle with the 1 hour trend, bad short eurusd against the trend, ok long audusd mentioned above, bad short audusd right after green long wick reversal candle. 1 for 4.

Questions

Tuesday, November 3, 2009

Poor results yesterday

Saturday, October 31, 2009

October wrap-up

Saturday, October 10, 2009

Weekly wrap-up

Monday, October 5, 2009

September wrap-up

Wednesday, September 23, 2009

Daily Activity 9/23

Monday, September 21, 2009

Weekly wrap

Going forward I see the pair trading in a range until something important happens so my plan is to short at or close to 1.5180 and buy at or under 1.5150.

I am still working on the EUR/USD moving average cross trade. More development is needed and I will keep refining my entry and exit strategy while trading mini lots. While on Blue Point's trading room another member that goes by the handle "Mack" shared with me some techniques for using long term moving averages and bolinger bands on the AUD/USD pair. I've been watching this pair recently and will try to incorporate his tactics, possibly taking mini lot trades this week. Basically, I'm still working on my trading toolbox to better maximize the assets of time and money.

Wednesday, September 16, 2009

Daily activity 9/16

Daily Activity 9/15

Tuesday, September 15, 2009

Daily Activity 9/14

Friday, September 11, 2009

Daily activity 9/11

Thursday, September 10, 2009

Daily activity 9/10

Wednesday, September 9, 2009

Daily activity 9/9

Tuesday, September 8, 2009

Daily activity 9/8

Saturday, September 5, 2009

9/4 learning

Trading log/diary

Friday, September 4, 2009

Weekly wrap up

Thursday, September 3, 2009

EURCHF trading/news update

Morning EUR/CHF news updates

Wednesday, September 2, 2009

EURCHF trading/news update

EURCHF trading/news update

EURCHF trading/news update

EURCHF trading/news update

Tuesday, September 1, 2009

EURCHF trading/news update

1st. With the notable exceptions of the USD and JPY, the CHF has been a strong

performer today in the midst of substantial stock market selling and other

indications of risk reduction across asset classes. EUR/CHF is thus far holding

to tight ranges and above the Aug 21 swing low and 200-day MA by 1.5135; last at

1.5154. With Swiss PMI beating EUR PMI today and, as a result, perhaps less

concern by the SNB about the CHF"s strength at this point, there could be scope

for a modest extension to the downside, but it is not clear the SNB will allow

the pairing too much room on the downside until Swiss CPI begins to trend higher

again. It would seem reasonable to assume they will defend 1.5000 should it come

into play again soon.

On the topside, offers remain at 1.5185, with more offers in the 1.5215-20

and 45 vicinities.

Monday, August 31, 2009

Sunday, August 30, 2009

Trading update 8/30

Friday, August 28, 2009

Trading update 8/28

Thursday, August 27, 2009

Trading update 8/27

Wednesday, August 26, 2009

Trading update 8/26

Friday, August 21, 2009

Weekly wrap up

Thursday, August 20, 2009

Long positions open

Wednesday, August 19, 2009

Tuesday, August 18, 2009

EUR/CHF udpate

SNB news update

Link to Zero Hedge blog post about the CHF

EUR/CHF news update

Monday, August 17, 2009

Swiss retail sales results

Macro players pressured the Franc into the release, with USD/CHF hitting a 1.0789 peak. This was aided by the EUR/CHF recovery to the 1.5240 highs, with locals once again jittery over official Swiss interests in the cross towards 1.5200. Offers into the 1.08-area will remain in focus following the release, as long as EUR/CHF continues to head higher. Look for a pop above the figure to generate fresh follow-through.

Saturday, August 15, 2009

Next week's economic data releases

Friday, August 14, 2009

Account finally switched over

Article about how to gauge your success as a trader

Thursday, August 13, 2009

Euro-Swiss News Update

euro-Swiss (currently Chf1.5305) comes in at Chf1.5270. "A break of

Chf1.5270 opens downside potential downside potential to Chf1.5080"

they say. BNPP also notes scope for a new wave of risk aversion.

"Reports that NYSE volume remains at the lowest levels of the year have

raised fears that recent equity gains are vulnerable and were more

attributable to cutting of shorts than genuine demand" the strategists

say. Any larger stock sell-off would likely mean increased demand for

low yielding currencies (Swissy) they say. Volume on the Dow Jones

Industrial Average peaked at 9.098bn contracts on March 18 followed by

another peak of 9.12bn on May 7. Low volume was seen on Jan 2 (4.048bn)

and July 10 (3.912bn). In August volume has ranged from 5.4bn contracts

(Aug 10) to 6.8bn contracts (Aug 7)

8/13/2009 10:50:11 AM

EURO-SWISS

BNP Paribas strategists note that for....

Wednesday, August 12, 2009

Trading is like Chess

Monday, August 10, 2009

Stockwtits TV

Monday, August 3, 2009

July month end wrap up

Friday, July 31, 2009

Quick move down

Thursday, July 30, 2009

Trading Update 7/30

News update on the Euro-Swiss

Trading Update 7/30

Another Euro Swiss news update

Interesting morning action

Wednesday, July 29, 2009

News update on the Euro-Swiss

Trading Update 7/29

Tuesday, July 28, 2009

Missed opportunity?

Monday, July 27, 2009

Trading Update 7/27

Sunday opening action

Saturday, July 25, 2009

Weekly wrap-up

Wednesday, July 15, 2009

Charts and Trades

Tuesday, July 14, 2009

Trading update 7/14

Monday, July 13, 2009

Interesting article on currency trading

Sunday, July 12, 2009

Weekly wrap-up

Thursday, July 9, 2009

New middle eastern currency delayed

Trading update 7/9

Wednesday, July 8, 2009

Trading Update 7/8

G8 meeting

Tuesday, July 7, 2009

Monday, July 6, 2009

Trading update 7/6

Break to the downside

Starting the week

Friday, July 3, 2009

Small spike this morning

Thursday, July 2, 2009

Trading update 7/2

More from the SNB quarterly report

There isn't much more about their past or future interventions but there is some interesting economic data and viewpoints. Basically, they think that the economies of most industrialized nations will begin to grow modestly late this year, mostly as a result of government stimulus. China has already hit the bottom and should rebound quicker than the rest of us, and it will take a number of years for the various governments to recover from this massive stimulus/debt binge. Chart 2.4 on Page 17 gives a pretty good graphical representation of why the Swiss economy is so closely tied, and their currency so correlated, with the European Union, and its all about exports.

Today's news events

The only noticeable impact of either event is the EURCHF retracing half of the move upward that came on the heels of the quote I shared in an earlier post from the SNB. This retracement could also just be the natural order of things and have nothing to do with either news event today.

SNB comments this morning

Wednesday, July 1, 2009

Trading update 7/1

There is still, in my opinion, a sense of uncertainty about when or if another intervention could happen. There's the U.S. Unemployment numbers tomorrow and then the long holiday weekend here in the U.S. which does make me question whether or not the SNB could take advantage of the expected light volume on Friday to run the pair up going into the weekend.

Tight range this week

June wrap up

I opened and closed a total of 16 trades in the month of June. Since I leg into positions this isn't an accurate representation of total positions traded, that number is closer to 10. This trading strategy does not require extremely active trading, which is one of its strengths. Going into July I am still holding 1 long position.

Friday, June 26, 2009

Trading update 6/26

All of that is nice to know but it doesn't affect the way I trade on a daily basis. The next long entry for me would be under 1.5210 which could be a stretch for today. This current downward move could be more correlated to the USDCHF being close to session lows, after all the EURCHF necessarily has to be close to if not exactly the result of the EURUSD multiplied by the USDCHF.

Zero Sum Game

Slow morning

Thursday, June 25, 2009

Trading update

More madness

Good call yesterday

Wednesday, June 24, 2009

Good morning SNB

Monday, June 22, 2009

Slow start to the week

The beginning of this week could be quite slow with traders waiting for the Federal Reserve to finish their meeting and release their statement and the Fed Funds rate at 2:15pm EST on Wednesday.

Friday, June 19, 2009

Still Trading

Tuesday, April 14, 2009

Mid-day update

Trading results 4/13

Monday, April 13, 2009

Reserve Currency Madness

Trading results 4/10

Friday, April 3, 2009

Today's tight range = US Employment numbers

Last month it came in at -651k. The consensus, or expectation, for this month is -659k. If the report is close to that number on either side the response will be fairly muted. However, if it is very weak the dollar with get hammered. If it is a lot better than expected the dollar will probably rally. The way I setup positions to be relatively dollar neutral this could be a non-event either way for the portfolio. It still has to be watched because if one side or the other moves at a greater velocity it might create opportunities to close positions at higher then normal profit.

Trading results 4/2

Thursday, March 26, 2009

Trading results 3/26

Wednesday, March 25, 2009

Trading results 3/25

Thursday, March 19, 2009

Trading results 3/19

Wednesday, March 18, 2009

Trading results 3/18

Tuesday, March 17, 2009

Trading results 3/17

Mid-day update 3/17

Monday, March 16, 2009

Mid-day update 3/16

Friday, March 13, 2009

Mid-day update 3/13

Actually this is a good time to mention my exit strategy. When the pair reaches my targeted exit I close the side of the trade that is at a loss and put a trailing stop on the side in profit to see if I can catch a move on that one pair. It doesn't run every time, or even most of the time, but when it does it can multiply what would've been a nice gain by 2 or 3 times.

Its reassuring to see that absent the craziness from yesterday the premise is sound. Not expecting much for the rest of the day, Friday afternoons tend to be very quiet since the rest of the work is already enjoying their weekend.

Thursday, March 12, 2009

Trading Results 3/12

Wow! Bad Day.

Wednesday, March 11, 2009

Trading Results 3/11

Mid-day update 3/11

The trading plan

A third pair is chosen as the trigger for entries and exits because it is a combination of the two traded pairs. I watch this pair for movements of a minimum size to enter a position. If the trigger moves up the required amount I will enter a short position in both traded pairs, if it moves down instead I will enter a long position. When/if after my entry the trigger pair moves back towards the starting price I will close the position. That is the main theory of the strategy, the price will revert to the mean over time.

What is being traded?

EUR/USD and USD/CHF pairs.

Trigger for entries/exits?

EUR/CHF.

Schedule for entries/exits?

1lot -0.25( or +0.25 of course)

lot 2 -0.25

lot 3 -0.25

lot 4 -0.50 exit 0.25 pull back (pb)

lot 5 -0.50 exit 0.25pb

lot 6 -1 exit 0.50 pb

lot 7 -1 exit 0.50 pb

lot 8 -2 exit 1 pb

lot 9 -2 exit 1 pb

lot10 -3% double lots exit 2pb.

A lot is also referred to as a position and consists of the combination of both traded pairs entered at a specific time. The -.25 is referring to a percentage move so I'm looking for the EUR/CHF to move +/- .25% from the closing price before entering the first position and so on. Unless otherwise specified above I close a position when it retraces .25% in the direction of the trade.

Ratio of EUR/USD to USD/CHF?

The goal is to be as close to U.S. Dollar neutral as possible because that helps to eliminate one more risk to the portfolio. When entering a trade I check to see what the EUR/USD is trading at because this is used as a quick reference on the ratio I want to maintain. As an example if the EUR/USD is trading at 1.50 then every position is long/short 100,000 Euros and short/long 150,000 Dollars. I want to cover these 150,000 Dollars so I will buy 1.5 units of USD/CHF for every 1 unit of EUR/USD. This means my effective trade could be long 100,000 Euros, short 150,000 Dollars and long 150,000 Dollars, short 116,000 Swiss Francs (assuming the USD/CHF is trading at 1.16). It isn't important how many more or less Euros or Francs are in each position, just that as much of the Dollar risk is hedged out as possible.

Size of each position?

I stay between 3 and 3.5% of the total portfolio value for each position. So for each $100.00 in the account I only want to start with $3.00 to $3.50 total between both pairs. The reason for this is that the price doesn't always revert back to the mean immediately, sometimes it can move against me for quite a while so I need to have the capacity to open more positions and not get a margin call. The second important fact that impacts the size is the ratio mentioned above.

Time frame and what to use as a starting point?I only use a 1 hour chart of the EUR/CHF but it doesn't really matter much. As far as a starting point to determine how far away from the mean the price moves I use the GMT 0:00 opening price as my starting point (this is the open of the bar at 7pm EST).

When I trade?

I try and watch the market as much as possible but the best times seem to be from the opening of the London session to mid-afternoon in the U.S.

Tuesday, March 10, 2009

Trading Results 3/10

Monday, March 9, 2009

What is currency trading?

Here are some FAQs from Investopedia but the nuts and bolts are that the currency market is a worldwide, completely electronic market for the buying and selling of foreign currencies.

What makes it different from trading stocks, commodities, or options?

First, the hours. Depending on which broker you choose you can take trades 24 hours a day from 5pm Sunday to 4pm Friday. How is this? The market services the entire globe so when the east coast of the U.S. is finishing dinner the Asian markets are just getting warmed up. An hour or so before they call it a day the London session kicks into gear and takes us well past the traditional start of the trading day in America.

Second, the volume. Depending on who you talk to the average daily dollar amount of trades is anywhere from US$2 trillion to US$3.5 trillion. Compare that to the highest monthly dollar volume the NYSE Group has had in the past 5 years of US $3.6 trillion. When you take this extremely high volume and divide it across the 20 to 30 pairs able to be traded at most currency brokers, instead of the thousands of stocks listed on any given exchange you get one beautiful thing....liquidity.

Third, the leverage. If you want to lever up (trade more shares of a stock than you can afford) in the stock market you have to have a fairly large account and have to borrow the shares on margin from someone, most likely your broker. Currency brokers provide automatic leverage from 50:1 to 400:1 or even higher. This is actually necessary in most instances anyway since the standard currency contract size is 100k. This makes the barriers to entry very small.

It begins

This is best described as a mean reversion dollar neutral hedge strategy, which I'll get into more as I go along. I did not come up with this system. Rather it was posted on ForexFactory, a currency trading forum. I will attempt a brief description of the strategy but anyone interested in trading should read all of the posts for Spieler’s strategy here.